Warehouse Design – Entry Level Picking Solutions (AMRs and rack-to-person AMRs)

Posted on 21st July 2023

This discussion focusses on ‘entry level’ picking solutions using autonomous mobile robot (AMR) technology, specifically goods-to-person (GTP) AMRs and rack-to-person robots.

These automated solutions offer flexibility, improved picking performance, relatively low costs and, in the case of AMR robots, fast implementation. However, there are many factors affecting the business case, so the decision to adopt this technology is complex.

I will review the benefits of these solutions and highlight some possible negative aspects. This includes how to approach evaluating automation, whether robots are suitable for your application and how you can move forward.

Table of contents

1. The challenges to implementing AMRs

These types of solutions are very popular at this moment. However, underuse of the equipment outside of peak season each year is a problem. This is important when interest rates are high and a recession remains a real possibility. It has never been so difficult to forecast future volumes and trends.

Another obstacle to entry is the allocation of third-party contracts, which are typically for three or five years. Achieving a return on investment (ROI) within the contract period is a limiting factor when considering automation solutions.

In most cases AMR solutions can deliver significant increases in picking performance. However, the replenishment process associated with stocking the racks for GTP AMRs can be a time-consuming process. This is a potential downside that’s often overlooked.

2. The benefits of using AMRs

Locus Robotics

AMRs navigate without any infrastructure, effectively free roaming around the warehouse as they become accustomed to their environment. See my earlier blog for a more detailed description of AMRs.

Locus-Robot.

Summary of the benefits of AMRs:

Deployment is fast without making major physical changes within existing warehouse rack or shelving areas.

Lead times as little as three months are achievable, assuming the robots are available.

Pick rates typically improve by two or three times compared with traditional methods.

Delivery of picked orders and totes is direct to a pack station or consolidation point.

AMRs can vary in size to transport loads up to 1,000kg.

Robot numbers can increase in advance of known peaks, such as Black Friday.

AMR robots reduce the distance a picker walks in the warehouse, and the rack-to-person AMRs eliminate pick walks all together. This provides improved pick rates compared with traditional methods. Both concepts are also relatively quick to implement as an alternative to fixed infrastructure automated solutions. The return on investment (ROI) is usually expressed in months for AMRs and can be less than three years for rack-to-person solutions.

Geek + goods-to-person (GTP) AMRs.

Compared with traditional solutions pick performance improves two to three times using AMRs and rack-to-person AMRs four or five times.

TH Note: These figures are project specific, offered as a general guide but not guaranteed.

This is currently a huge growth area within warehousing automation. There is significant development and investment in these types of solutions. There are also more and more suppliers coming to the market with different types of robots. The logistics automation market size is estimated at US$68.46billion in 2023 and is predicted to reach US$109.76billion by 2028.

In addition to providing more efficient operations, easier finance options are available for these solutions. Transferring equipment from one warehouse to another is easy, making these solutions scalable. This is a significant advantage for third party logistics providers (3PLs) and multi-site users.

There are multiple factors affecting demand.

Continued growth of ecommerce operations, which by their nature, are pick-intense.

Reduced availability of labour and increasing pay rates.

The cost of energy and sustainability targets.

Peaks like Black Friday and other periods of variable demand are easier to handle with automated solutions.

Fewer forklift truck movements in a warehouse reduce accident rates and help manage health and safety risks.

Staff retention improves when operators do less lifting and walking which reduces fatigue or stress. This helps to maintain specific knowledge relating to products or customers.

The solution design includes pick accuracy, supported with visual aids, guided picks, product scanning and other technology.

I am sure you’ll learn something new about this fascinating area of automation from the following discussion. As an independent consultant I have no bias towards any supplier or any solution. I aim to review the equipment in both subjective and objective ways.

3. Technology not discussed here

I will focus only on GTP AMR and rack-to-person solutions and exclude other higher investment options. These typically take longer to design and evaluate and are less flexible. The fixed infrastructure is more difficult to expand and payback periods are usually more than four years.

These solutions include:

AutoStore

sorters (including pouch sorters)

automated storage and retrieval systems (ASRS)

mini load systems for smaller, lighter goods

Exotec, SqUID, carton or tote transfer

specialist vertical carrousels.

I discussed AutoStore in an earlier post and will cover the other systems in the future.

4. Labour availability and costs

Generally, operators who are considering deploying robots are looking to achieve two main objectives. Firstly, to reduce reliance on labour-intense and costly picking operations. Secondly, to achieve high levels of throughput. Here I’m focussing on labour.

We are all too familiar with trade journals describing how difficult it is to attract staff to work in warehouses. The crisis in Ukraine, a reduced pool of labour from the EU following Brexit, and the pandemic haven’t helped.

Companies are competing against others to attract and retain staff by offering improved facilities and flexible working hours. Enhanced employment packages might include annualised hours, canteens and restaurants, and on-site gyms, for example.

At the time of writing Amazon workers at Coventry are seeking a pay award of £15 per hour. Other sites including the Mansfield and Rugeley fulfilment centres are seeking similar awards. Amazon currently offers employees flexible working arrangements, £8,000 towards tuition fees and private medical insurance.

Financial analysis predicts the Bank of England will maintain high lending rates for some time. This further affects the labour situation and adds to pressure on wages.

In my work as a consultant, it’s common for warehouse managers and directors to say they want to use automation. The headaches associated with attracting and retaining staff are usually their biggest concern. Most of the sites I visit rely on costly agency staff to supplement their core team. However, training and reported turnover of agency staff is also a problem. Every year peaks such as Black Friday and Christmas involve training for additional short-term staff. Resolving these issues are significant challenges.

Employees often find it difficult to learn traditional warehouse operations using radio frequency identification (RFID) or even paper picking lists. Another factor affecting resource planning is the learning curve for new staff who might take four weeks to hit targets.

Many operations are also reviewing their warehouse management system (WMS) functionality. Many WMSs can be inflexible, resulting in inefficient operations which might not be robust. Misidentified locations and products often due to poor warehouse layout lead to picking errors. The resulting disgruntled customers and high levels of returns add to processing costs and use valuable resources.

In a warehouse, picking tasks typically account for 60% of the labour hours. I would argue that recent increases in ecommerce orders mean packing also uses a lot of the labour team’s time.

Locus Robotics

5. Rack-to-person AMRs

I haven’t previously discussed rack-to-person AMR operations. These move racks (mobile shelf units or MSUs):

within the storage grid

to induct

and to pick stations.

This can result in a dense storage solution when compared to traditional rack and shelving alternatives. Often installed below or on a mezzanine floor, they ideally suit low height warehouse areas. A load bearing mezzanine structure is needed to handle the weight of the robots and shelves.

Another consideration is the need for floor tiles. As AMRs repeatedly follow the same path, grooves often develop in traditional bonded resin chipboard floors.

Considering this type of solution early in the design process adds scalability with additional AMRs and MSUs. This allows storage and throughput capacity to increase as required.

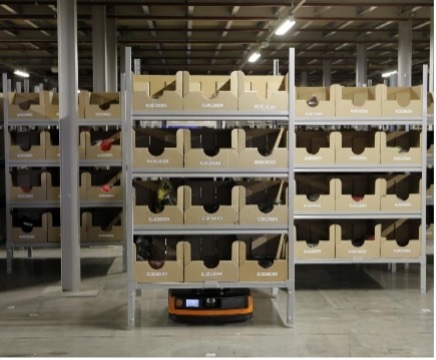

6. Racks

Storage racks with hanging garments and boxed items.

Racks can hold a variety of different bins, totes, cartons, hanging garment rails or even palletised loads. AMRs come in different sizes and lifting capacities. They navigate around the grid and lift units from below.

Access heights for warehouse operators limit the overall rack height, typically to approximately 1.7metres. Access is usually from two opposing sides and the racks need space in the base for robots to lift them.

7. The grid

The grid is a clearly defined area within the warehouse. Ideally the area is fenced off for safety and security, with access restricted to trained technicians. The area has space for charging robots with scheduled charging included in the warehouse execution software (WES).

Hikrobot at Superdry.

AMRs move racks to storage locations designated by the system. The robots scan and follow quick response (QR) codes on the floor to navigate between locations. The WES allocates storage locations based on the concept of ABC analysis of picking frequencies. This creates fast- and slow-moving zones to minimise rack travel distances. The faster moving stockkeeping units (SKUs) and racks use the most accessible locations. Storing the fast moving SKUs across multiple racks also improves throughput during peak demand in fast pick environments.

8. Induct and picking workstations

Workstation areas have access to the racks. Designed to serve as induct or picking points, they include light sensor protection for operator safety.

Work associated with picking is much higher than induct so there are more picking stations. In many cases picking stations have pick-to-light racks and pick walls. Sometimes laser guidance is included to direct operators to totes or locations. They also have computer terminals and screens.

Ideally workstation design is suitable for either induct or picking activities to provide flexibility as demand varies.

8.1 The induct process

Operatives use a terminal at the workstation to scan products. This provides traceability and control, identifying which items are on each rack and rack location. The induct items are directed from reserve storage or on receipt for new items.

8.2 The picking process

The robot presents racks in sequence as required for the picking process. There is normally a buffer zone before the pick station to sequence racks so there’s no waiting time.

The picker uses a computer terminal to identify the storage location to pick from. This can be done with laser guides, the SKU code and pick quantity. In some cases, an image of the items to be picked is also displayed.

Items are added to totes or cartons on trollies or directly into the dedicated order consolidation shelving or ‘put’ wall. The design is specific to the operation. One rack presentation can include multiple pick lines for multiple orders. Multiple orders might use one SKU or multiple SKUs on the same rack might satisfy several orders. When picking for the orders is complete the totes or trollies go forward for packing.

8.3 Additional picking

It’s rare to store all the stock in a warehouse in the GTP area, so additional areas are often required. These might include:

• very fast-moving lines possibly located within the pick modules

• very slow-moving lines possibly stored in high bay racks, or remote shelving locations such as a mezzanine floor

• oversized items which might need a different solution

• heavy items that need separate consideration.

This part of the solution design is important. Real productivity gains across the whole process can be achieved when very fast-moving lines aren’t inducted into the pick solution.

8.4 Reserve storage

The GTP area often receives replenishment stock from reserve storage locations in the warehouse. Stock replenishment is typically at case level, based on minimum and maximum quantities to determine the items needed.

Tip: Maintaining the correct SKUs in the GTP area is crucial to achieve efficiency targets. Storing products in the incorrect location has a negative impact on overall system efficiency.

9. Returns processing

Superdry returns processing AMR solution.

In ecommerce operations returns are significant, particularly in fashion where they can represent approximately 40% of the outbound volumes. Fast processing makes sure they are inducted into the pick solution to fulfil future customer orders. The WES might even prioritise returned items in the pick process to release a storage slot for new receipts.

10. The packing process

Order processing speed through GTP stations is part of the packing process design. Typically, picked orders go into totes located on trollies. The trollies move to packing stations or totes go straight to packing using a conveyor. Increasingly, we see automated packing solutions used for ecommerce operations.

TH comment: If you have got this far, and you think robots might provide a cost-effective solution to your business needs, then you might ask: ‘How do I start the process of reviewing what options are available and which solution is best?’ Below is my suggested approach.

11. How to approach evaluating automation

11.1 Base case assessment – current state

The best place to start the assessment is to review the base case or current state, which I have previously discussed.

The main outcome of the process is a material flow and resource model of the current state. The analysis focusses on mapping the volumes processed through each stage of the warehouse during peak and average weeks. It’s also important to consider the peak day within the weeks modelled.

The purpose for mapping the peak is to determine the resources needed. This includes the labour and equipment required during peak volumes. Mapping the average determines the level of resource needed to cover most of the year. This is the level of employees needed in your core team. A number of alternatives could cover the peaks. Options include working extended shifts and overtime, weekend working, agency staff, and short term hire of additional warehouse equipment.

Detailed analysis of single SKU orders is another vital and often overlooked step. This is important to understand how they are currently handled, and how to handle them in future operations. Automation coupled with a sophisticated WES can allow a delayed bulk pick of single SKU orders. Ideally this takes place in a separate area of the warehouse. This could also suit an automated packing solution.

A key output of the base case analysis is KPIs. Many warehouse operations have clearly defined KPIs to manage resource requirements, monitor performance, and ultimately improve efficiency.

11.2 Future state

Following approval of the base case scenario, models can show future forecasted demand. This allows assessment of processes and equipment to understand the operation’s capacity to meet target volumes.

11.3 Next Steps

Following the initial review and proposals, a consultant should follow these key steps:

A documented summary of requirements for any new automated system.

A review of automation options to arrive at a concept design.

Subject to client approval, a simulation of the shortlisted option.

Finally, assuming the business case is viable, vendor selection and engagement. To do this your consultant identifies the most suitable solution with overall costs and lead times for equipment and implementation.

12. Artificial intelligence

I think this is an exciting period where technology is advancing at a rapid rate. We shouldn’t ignore how artificial intelligence (AI), coupled with machine learning (ML), could ultimately increase the benefits of automation.

The simultaneous development of technologies across ecommerce, warehouse management and logistics affects the whole supply chain. For example, ASDA board members, Walmart, have extended their partnership with the AI supply chain technology group, Symbotic. The group is rolling out robotic solutions and software automation platforms at all Walmart’s distribution centres. The trend towards integrated ecommerce and key business systems will certainly streamline and simplify operations.

Swisslog CarryPick.

13. The Control System – warehouse control system (WCS)/warehouse execution system (WES)

As with any robotic application a control system works in the background. This system uses a combination of logic and algorithms to determine equipment use to maximise overall efficiency.

The software will:

Sequence racks to the pick station and direct them into storage and induct.

Minimise how far robots travel by relocating the most accessed racks to more accessible locations.

Maximise efficiency of the robots including planned charging times.

Batch orders in line with picking strategies.

Plan stock taking tasks during downtime and scheduled low level count confirmations.

Induct received items and process returned items, scheduled outside of peak picking periods.

The control system interfaces with the client’s host system to confirm stock adjustments and picks completed.

14. Financing the project

The traditional approach to financing large investments in items such as robots and automation is through capital expenditure (Capex) or operational expenditure (Opex). Capex purchases include significant goods or services used to improve a company’s performance in the future. Opex expenditure covers day to day running costs.

However, suppliers now offer alternative payment options, including robots as a service (RaaS) and pay as you go (PAYG)

14.1 Robots as a Service (RaaS)

Paying a rental or subscription charge that can include servicing and maintenance removes the upfront cost.

Upgrading or downgrading systems as requirements change making it easier to increase capacity for known peaks and volatile demand.

Cloud-based programming makes introducing additional robots to an existing solution fast with minimal disruption and cost.

14.2 Pay as you go (PAYG)

Transactional activities provide the basis for the commercial terms. The contract includes minimal use rates to cover low levels of demand to protect supplier fixed costs.

15. Conclusions

Some clients are really determined and take a narrow approach when reviewing robots in their warehouse. They want to have an innovative operation to showcase in their marketing material.

However, it’s too easy to fall into a trap. Selecting something because it looks good on a website or You Tube video does not make it the right choice. The decision needs long and hard consideration.

The cost is comparatively high and choices are based on what we know today. We didn’t predict a pandemic and we are on the brink of a recession. Interest rates are likely to remain high for an extended period. Sound data analysis helps justify the investment with a higher level of confidence. In contrast, failure to invest could mean a business struggles to meet the quality and speed of competitors.

I have described systems that can absorb variations in demand and provide robust processes compared with traditional methods. As you might have gathered from my other blogs, I find all these technologies exciting. However, there is a right time and place for each solution.

I can offer tailored solutions to meet your specific needs. I work with small businesses looking to streamline their operations and large corporations in need of advanced automation. My expertise is in warehouse management systems and automation technologies. I am happy to assess your current processes and recommend the most suitable solution for your business.

If you’re considering any form of automation or want to optimise your warehouse operations don't hesitate ask for advice. I would be very happy to provide a quotation for any assistance required.

Share this post: